Wanxiang purchased more than 20 electric vehicle battery patents from its A123 unit

Dec 05, 2019 Pageview:2459

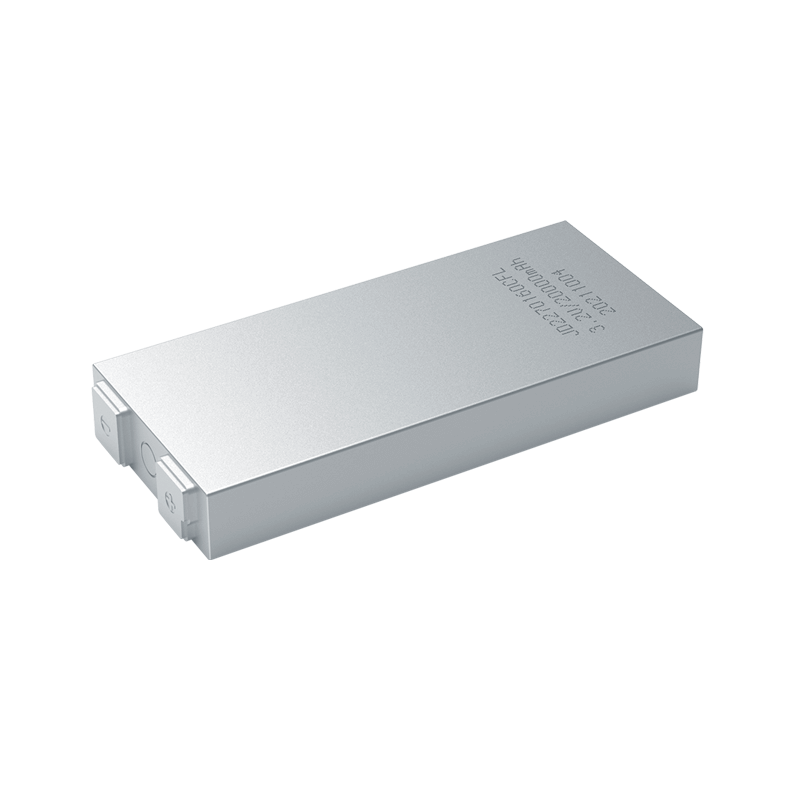

Wanxiang group's U.S. battery plant, A123SystemsLLC, recently purchased a patent from Leyden energy for its electric vehicle project.

A spokesman for A123 was quoted as saying the company had purchased more than 20 patented technologies and brought in professionals from Leyden, but did not disclose the amount involved.

Leyden's flame-retardant electrolyte and lithium titanate technology could be used to quickly charge electric cars, the spokesman said. A123 has previously developed batteries for fisker cars.

On February 15th wanxiang group became the new owner of fisker, an American electric-car giant, for $149.2m.

Wanxiang group announced on May 17 that it will be the first to produce the fiskarma model in the United States, and will gradually start producing other hybrid models. The group did not disclose a timetable or other details.

Join hangzhou/go to sea to prepare for byd tesla

Byd's foray into hangzhou tesla and samsung SDI is locking in China

Wang, who lives in the east of hangzhou, has been driving a pure electric taxi for three years. In his eyes, the car is very good, do not drink gasoline and subsidies, but there is a little bad - the battery's single range is too short, less than 60 kilometers. Master wang thought, when the time is ripe, for a higher mileage car to drive. As battery technology continues to evolve, the common weaknesses of this all-electric vehicle will improve. In late April, byd boss wang chuanfu brought a new energy car partnership to hangzhou. In the future, byd will choose this site to produce industry-leading electric buses and electric cars, including the E6 pure electric car with a range of 300 kilometers.

In the past few days, the popular tesla has come to hangzhou. Similarly, it is a big fan of thumb up. "As the world's largest car market, China's growth in pure electric vehicles cannot be ignored," tesla CEO elon musk said on his debut in China. "" in 2014, tesla has a sales target of 30,000 vehicles and a target of 5,000 vehicles in the Chinese market.

Electric cars are here, and companies that make batteries for them are busy laying them out. According to statistics, China accounts for about 4% of the global automotive battery market. Professional institutions predict that China's market share will rise to 20 percent by 2020. Industry insiders said that as electric car companies compete for territory, domestic and foreign battery manufacturers layout has begun.

Battery technology is getting newer every day

If electric cars are to sell well, the way they are charged must keep up. For example, the zotye all-electric taxi currently in use in hangzhou relies mainly on battery replacement. From this year, hangzhou has strengthened the construction of charging and changing stations in the city, planning to build a charging ring of 5 kilometers in the city and 10 kilometers in the suburbs. Beijing, on the other hand, compresses the annual allocation index of small passenger cars and increases the proportion of new energy vehicles year by year. In addition, many cities have released their own charging ring construction schedule, and in the national introduction of new energy vehicle subsidy policy, to give electric cars all kinds of car and even licensing concessions.

According to the public information, the delay of the launch of tesla's ModelY model is mainly due to the tight supply of car batteries and the temporary suspension of production of ModelS. Tesla has partnered with panasonic of Japan to supply lithium-ion car batteries. Under the lithium ion battery supply contract signed by the two sides, it will provide 2 billion lithium ion battery units for tesla in the next four years. At present, tesla has completed the delivery work for the first batch of car owners in Beijing and Shanghai, and has taken the lead in the construction of three supercharger stations, including two in Shanghai and one in Beijing. The charging station can provide 24-hour charging service, and tesla electric vehicles can complete about 80% of charging in half an hour.

With preferential policies, technology should also keep up. Byd, for example, has developed green hybrid technology, an advanced vehicle energy management system. Et-power iron battery technology replaces the traditional 12-volt lead-acid battery with a safer, more durable and more environmentally friendly 48-volt lead-free iron battery. The motor of the whole vehicle is intelligent in frequency conversion. The motor and turbocharged engine can achieve double supercharging through seamless cooperation. The whole vehicle can accelerate by 1.5 seconds for 100km and save fuel by 1.5l.

Domestic and foreign battery manufacturers are facing fierce competition

Domestic and foreign battery manufacturers have entered the field of electric vehicles. Samsung SDI regards the Chinese market as one of the most important markets in the global automotive battery market, actively explores the replacement market of traditional lead-acid batteries, and will actively respond to the Chinese market with batteries with the highest energy density and the best performance. Among domestic enterprises, zhejiang enterprises are ahead of the industry. Tianneng group has a market share of 51% in the field of low-speed electric vehicles and cooperates with more than 100 domestic enterprises including saic motor. Since the successful acquisition of American battery manufacturers, wanxiang group is promising in the industry. Also well-known is byd lithium battery co., LTD., which has become the country's largest and the world's leading mobile energy supplier.

"In fact, domestic batteries are no worse than foreign ones." Industry insiders said that the range of full-charge domestic batteries has been greatly increased. Currently, a number of companies have developed products with a range of more than 200km for a single charge, and the number of charging cycles has been greatly increased. The application of the new colloid battery liquid technology realizes the intelligent control of the battery, and solves the problems such as short cycle life of the power battery, short range of one charge, low specific energy and early capacity attenuation.

Industry insiders said that although electric vehicle manufacturers have a lot of procurement options, but the price of battery research and development is still high, leading to the price is not low, and charging facilities are not very perfect, electric cars can scale application is still a problem.

Wanxiang China's "dream making" hits tesla's home directly

Wanxiang group, China's largest auto parts maker, plans to build and sell electric cars in the United States to compete with tesla.

On February 15th, wanxiang group became the new owner of American electric car giant fisker for $149.2 million. The abandoned general motors plant in wilmington, Delaware, owned by fisker, is the key to wanxiang's push into the us electric car market.

Wanxiang revealed on May 17 that it will be the first to produce the Karma model in the United States and will gradually start producing other hybrid models. The group did not disclose a timetable or other details.

Unlock wan xiang lu guanqiu: "dream" tesla

Wanxiang group founder lu guanqiu, 69, seems to be one step closer to building a car, from buying A123, an American maker of lithium batteries, to acquiring fisk, an American electric-car company. However, the poor performance of wanxiang electric vehicles in the domestic market and the unclear intention of wanxiang's acquisition of fisker raise doubts about whether wanxiang can become the "tesla of China".

A month and a half ago, after the Delaware bankruptcy court approved wanxiang's acquisition of fisk, the company, which started 45 years ago as a farm machinery repair company and is now China's largest auto parts company, was hailed by its fans as "China's tesla".

Guotai junan analyst report that at the time, wanxiang group, at the same time has the world's most advanced electric vehicle battery company (refers to A123), electric vehicle company (,), and universal group has promised to inject universal money-is-coming electric car business, think it is very excellent new energy vehicles to universal money-is-coming mark, coordination with A123 fisker could create another "tesla."

After the acquisition news was announced on February 17, 2014, wanxiang money rose by the daily limit for three consecutive trading days.

Wanxiang qian chao clarified in the subsequent announcement that it would only invest in wanxiang electric vehicles after the company's earnings stabilized. Fisker is a plug-in electric vehicle, and wanxiang electric vehicle pure electric technology line is completely different, the success of the acquisition of wanxiang electric vehicle company will not have an impact on the development.

Lu guanqiu, the 69-year-old founder of wanxiang, has always dreamed of making cars, but he is cautious by nature. He doesn't have the lofty spirit of his hometown li shufu declaring that "a car is four wheels and two sofas".

In 1999, he saw the promise of electric cars and started with battery research, gradually making big acquisitions overseas. But wanxiang has so far failed to make money on its electric cars, nor has it launched an electric car aimed at individual consumers. It is hard to believe that wanxiang will be the future leader in electric cars in China.

Could the acquisition of fisker, the leading us electric car company, change the fate of wanxiang's electric cars?

"The more I know, the more I fear."

"The car industry is a capital-intensive, technology-intensive and mature industry, and it is too risky to rush in when you see a high profit margin."

"Do you want to build a car?

"In my dreams. But strength is not enough. Wait for a condition good, do car certainly. My generation can't do it. Lu guanqiu, a deputy to the National People's Congress, said in an interview during the two sessions 11 years ago.

More than a year later, lu guanqiu further explained in an interview that wanxiang should have three conditions for making cars: its own ability, social environment and the strength of its partners. He believed that wanxiang had insufficient capital and human capital at that time, and it did not have a team to master the core technology of automobile. It was far away from the target of 100 billion yuan in revenue, and the social environment was not allowed, so the threshold was too high.

"The more I know, the more I fear, that the auto industry is a capital intensive, technology intensive and mature industry, and it is too risky to rush in when you see high profit margins." He said.

Mr Lu was right to be worried. There were plenty of examples of people who had broken into car manufacturing and ended up losing, from "amateurs" such as oaks and waveguide to car parts companies.

In 2000, wanfeng auto entered the vehicle production through the acquisition of Shanghai changfeng passenger car factory, and established Shanghai wanfeng automobile company, which mainly produces SUV, and stopped production in 2006. In 2003, huaxiang group entered fuqi automobile in the form of acquisition and capital increase, invested hundreds of millions of yuan, also produced SUV, and stopped production in 2006.

In 2004, it was also reported that wanxiang tried to borrow changhe automobile to enter the vehicle manufacturing industry. Wanxiang denied this, saying that the two sides only set up a modular automobile factory in a joint venture. To be sure, in 2004 the national development and reform commission received more than 40 applications from private enterprises in zhejiang province for entry into the automobile production catalogue, among which wanxiang was one of them.

Also in zhejiang, geely, which started with refrigerator parts and secretly produced cars under the banner of motorcycle, took the lead in becoming the first private automobile enterprise in China to obtain automobile production qualification in 2001. By contrast, wanxiang's strong ideas and practical actions seem out of step.

Until June 2005, wanxiang, as the initiator, participated in gac shares, accounting for 3.99% of its total share capital, and became the second largest shareholder of gac shares. It was indirectly involved in automobile manufacturing, but it chose the direction of new energy vehicles.

"Here's your chance to make big money!"

"In the future, if it is successful, we will make electric cars, fulfilling our decades-old dream of cars. If it doesn't work out, we'll go back and make parts for electric cars.

On April 25, 2009, wanxiang invested 1.365 billion yuan to build the largest production base for electric vehicles and lithium batteries in China. Minister wan gang of the ministry of science and technology led a number of directors of the ministry of science and technology to attend the ceremony in hangzhou.

This is the first large-scale celebration of wanxiang in its 40 years of operation. In 1979, lu guanqiu saw in a newspaper that China was going to develop a transportation industry, and he decided to cut the agricultural machinery business -- reducing wanxiang's income by 1 million yuan that year. The company, which accounted for nearly half of its total revenue, started to focus on one of the core auto parts, the universal joint, and gradually grew into the largest auto parts company in China.

In his speech, lu mentioned, "why do we have electric cars? In addition to bullish international trends and national policies, but also because it is an extension of wanxiang's 40-year automotive parts advantage. In the future, if successful, we will engage in electric cars, round our decades of car dream; If it doesn't work out, we'll go back and make parts for electric cars.

Wanxiang's electric car project began in 1999. This year also happened to be the year when the EV1 project of general motors, the earliest pure electric vehicle in mass production, was aborted. The reason why wanxiang started the project was the national "clean vehicle action" co-sponsored by relevant departments of the state council, provincial and municipal governments and large automobile enterprise groups on April 6, 1999. In April 2000, wanxiang determined the development idea of "battery motor electric control electric vehicle", and established wanxiang electric vehicle co., ltd. two years later. Wanxiang developed polymer lithium ion power battery, motor and controller and other key parts, and successfully developed the first electric car and electric bus.

Lu guan ball this time to see the direction of the industry.

In 2009, the Chinese government issued the notice on the demonstration and promotion of new energy vehicles and the plan for the adjustment and revitalization of the automobile industry, and for the first time put forward the strategy for new energy vehicles. Automobile enterprises are competing to open new energy vehicle projects.

"Ten years, I've been working on electric cars for ten years, and I've never made a penny. Now comes the chance to make a lot of money!" Lu said at the groundbreaking ceremony.

But before they made a lot of money, wanxiang's electric cars were plagued by problems.

First there were quality issues with the all-electric buses on the streets of hangzhou in 2004.

On April 11, 2011, less than three months after hangzhou's first electric taxis hit the road, a zotye langyue pure electric taxi equipped with wanxiang battery suddenly burst into flames. While the third party identification, according to the report of the accident occurred cannot be determined the battery monomer design, manufacturing quality problems, but after the battery group cannot completely meet the requirements of vehicles using the environment, in the process of application, the battery leakage, insulation is damaged and the situation of the local short circuit, but the incident is a big blow for universal electric car batteries, a domestic power battery company executives to the southern weekend reporter said, "pin".

At the same time, wanxiang's two electric car projects with American companies have also suffered. In May 2010, wanxiang group and Ener1 (zhejiang), a joint venture company focusing on power cell and fuel cell business, invested more than 300 million us dollars in the first phase to establish a fully automated production base of battery cells and battery systems in hangzhou. Ener1 filed for bankruptcy protection two years later and has since restructured. For now, that deal has fallen through.

On February 17, 2012, wanxiang group and American electric vehicle company Smith signed a cooperation agreement on the BBS sino-us economic and trade cooperation in Los Angeles. The two parties intend to set up a joint venture subsidiary, in which wanxiang will invest us $100 million to develop and produce electric commercial vehicles, including pure electric school buses. But Mr. Smith's electric car partnership has been slow to progress, and the two sides haven't yet decided whether to build cars together in China, the wanxiang executive told southern weekend.

Is buying fisker a capital game?

A person close to the fisk acquisition told southern weekend that the real buyer of fisk is baic, and wanxiang is just the middle tier. Then wanxiang will transfer fisk assets to baic for profit. The news will be announced at the Beijing auto show in April 2014 at the soonest and one year later at the slowest.

In the past five years, wanxiang has not only failed to make as much money as lu expected, but also failed to make a profit.

On February 25, 2014, universal money-is-coming wanxiang group subordinate parts listed companies disclosed in a statement, "the current product yet universal electric motors in batches, unable to realize normal profits and losses in 2013 continued to", "because at present our country electric car production and consumption to many factors, is expected in the next two years, wanxiang ev vehicle is difficult to form scale".

A week earlier, after 19 rounds of bidding over three days, wanxiang bought American electric-car company fisker for $149.2m. That is about six times the price fisker had originally sought.

, as early as the beginning of 2013, on the verge of bankruptcy, from China's dongfeng, geely, baic have expressed interest, dongfeng group, has bid $350 million for a 85% stake in the plan, but in "expertise developed using the taxpayers' money should not be going to China" in the opposition, not below, finally and universal, the bid is Hong Kong tycoon Richard li tzar-kai's hybrid technology co., LTD.

To Joshua aparadise, a former clean energy analyst at Morgan Stanley, the acquisition seemed to make no economic sense given the paltry sales (1,800) and high cost of fisker's first camaro, according to the Boston globe. "Also like a vanity deal." He thinks interest in fisk might also stop wanxiang founder lu guanqiu from building a car.

One wanxiang U.S. executive who participated in the auction told southern weekend that the price was "totally a matter of talking and talking." The price depends entirely on the terms. Buying the same thing under different terms means different things. For example, the original fisker body manufacturing company proposed that the buyer could not own the fisker LOGO and would pay a usd250 fee for each car. However, the continuity of the last LOGO was used as the delivery term, and the LOGO itself might be worth tens of millions of dollars.

Wanxiang is a major U.S. acquisition

In 2001, the acquisition of the nasdaq listed company, the production of brake UAI (UniversalAutomotiveIndustriesInc.) 21 percent.

In 2002, the acquisition of UAI, an American listed company, became the first case of a Chinese township enterprise acquiring an overseas listed company.

In 2003, it acquired a "century-old store" in the United States, the inventor of the winged universal joint drive shaft and the world's largest primary supplier -- Rockford. Wanxiang became Rockford's largest shareholder with a 33.5 per cent stake.

In 2006, wanxiang lost out to a New York private equity fund in its bid for global control systems of the us, but the fund was forced to liquidate in 2008 amid the financial crisis. Wanxiang eventually acquired GSS in 2009.

In 2007, it acquired Dana, the world's largest maker of transmission parts. It has since been consolidated and sold to private equity for a premium.

In 2008, ford acquired the munro plant in the United States.

2009 acquired vista-pro, the no. 1 supplier of car heaters and water tanks to the U.S. repair market.

In 2012, it acquired A123 systems, an American lithium battery company.

In 2013, completed the overall acquisition of BPI, an international auto parts manufacturer whose core business is brake parts.

In 2014, it acquired Fisker, a us plug-in hybrid car brand.

According to the wanxiang U.S. executive, wanxiang was able to buy fisker because the terms it offered impressed the fisker debt committee. Universal acquisition, a total of $149.2 million, including $126.2 million in cash and $8 million in debt, and the universal enterprises designated a relationship between common stock, which specify the "relationship between enterprise common stock", specifically refers to include the purchase amount, universal, to follow-up investment, plus 12% per quarter compound interest, after full recovery, fisker, creditor committee has the right to a 20% dividend rights.

On October 11, 2013, li's Pacific century company won a us department of energy loan owed by fisker for $25 million. On Nov. 22, 2013, fisker filed for bankruptcy protection and was almost certain to be sold to Richard li's hybrid electric company for $25 million. It was Mr. Fisker's debt committee that filed a petition in the Delaware bankruptcy court asking the court to cancel the sale of a company that Mr. Fisker had agreed to sell to one of Mr. Li's companies and instead hold a public auction, backing wanxiang as a bidder.

Many people have compared fisker to tesla. In this executive's opinion, both tesla and fisker had quality problems in the early stage, but tesla persisted. Tesla is on the mass market, fisker is on the high end. Many people are limited by charging facilities. Tesla can own or not use them, but fisker is a plug-in electric vehicle, which is equivalent to bringing charging piles, which is more practical.

Jia xinguang, a well-known auto analyst, told southern weekend that fisker does its own development.

Wang shiyu, a domestic investment banker who recommended the fisker auto project through the tongxinhui fund in the first half of 2013, told southern weekend that fisker had no better Chinese partner than wanxiang. Wanxiang has not yet entered the vehicle market, should not be the problem of production qualification, but the product. With the acquisition of fisker, wanxiang has found the best channel to cut into the vehicle.

After acquiring fisker, lu spoke to only one media outlet, zhejiang daily. In the report, Mr Lu said fisker would be built in China and that "it is not clear when we will be able to build wanxiang's own car".

A person close to the fisk acquisition told southern weekend that the real buyer of fisk is baic, and wanxiang is just the middle tier. Then wanxiang will transfer fisk assets to baic for profit. The news will be announced at the Beijing auto show in April 2014 at the soonest and one year later at the slowest. The deal also involves an American company working as a middleman with baic to build cars in the future.

A person in wanxiang's public relations department conveyed a reply from wanxiang's senior management to southern weekend's reporter by phone: fisk is in the process of integration, and there is no news to be released.

The American wanxiang executive said he was not aware of the news, and said that wanxiang has investors involved in wanxiang's fisker plan. Wanxiang should not be able to transfer fisker to the Chinese vehicle manufacturer, but he did not rule out cooperation.

Hu enping, head of the public relations department at baic new energy, told southern weekend: I haven't heard of it. But baic does have a strong incentive to build electric cars. Zhang xin, deputy general manager of baic group co LTD, once said, "baic wants to make electric cars that can compete with ModelS around 2015." Baic inspected fisker and took aim at the second generation Atlantic model that fisker has developed but not yet put into production.

Since 2013, baic has been making frequent moves in the field of new energy vehicles, setting up joint ventures with South Korea's SK box and foxconn technology group for motor and battery technology. In February 2014, baic signed a share subscription agreement with Atieva, an American new energy company, to acquire 25.02% of Atieva. After the acquisition, the two sides are expected to launch electric vehicles of the same grade as audi A6L in the third year.

On March 21, 2014, Beijing new energy automobile co., ltd. was established in Beijing, and baic group became the controlling shareholder with 60% equity. According to the announcement of baic new energy vehicles, they have invested about 3,000 pure electric vehicles in the national demonstration operation of new energy vehicles. In 2014, as Beijing, Shanghai and other cities started to sell new energy passenger cars to private consumers, baic new energy set a sales target of 20,000 vehicles.

Similar pass-through capital operations have occurred in wanxiang's us acquisitions. In 2007, wanxiang acquired Dana, the world's largest maker of transmission parts, from the United States and sold it to a private equity firm. "Wanxiang is running capital around its main business," a media source who has long followed parts companies in jiangsu and zhejiang told southern weekend. Although lu guanqiu has been Shouting to build a car, I want to build a car, the son must want to build it?

Liu anmin, a senior investor, believes that wanxiang's capital operations are all around the industry. Electric cars are related to clean energy and auto parts, so wanxiang's transformation makes sense. Fisker is a good brand. If the business fails, the brand of wanxiang will also be damaged, which will stimulate its ability to do well in fisker. Lu guanqiu is so old, there is no retreat, there is no need to mess things up.

Wang shiyu said that now the state-owned enterprise reform advocates mixed ownership, baic has the brand, capital and channels, with the flexibility of wanxiang and baic's strong background capacity, cooperation is not inevitable, may be better than a single party to develop fisker.

Fisker automotive body manufacturing company, is (FiskerCoachbuild) with quantum world fuel system (QuantumFuelSystemsTechnologiesWorldwide) joint venture technology company, founded in 2007 by the original BMW, aston Martin designer Henry g - fisker (HenrikFisker) is founded. In January 2008, fisker unveiled its first car, the Karma, at the north American auto show. In July 2011, the Karma went into production and went on sale for $110,000.

Between 2008 and 2012, fisker received about $1.2 billion in venture capital. In 2009, fisker received $529 million in low-interest loans from the U.S. department of energy ($193 million of the first phase). To make matters worse, the carma has suffered a string of quality problems since its launch, with the Atlantic, its second plug-in hybrid, no longer in production.

In March 2012, consumer reports, a famous American automobile magazine, bought a camar that broke down when the odometer was routinely calibrated before a road test. Later, the magazine strongly criticized the car as useless, calling it "a poorly designed tank with hands tied". After investigation, the reason for the breakdown of the carma was a battery failure of A123. A123 was forced to recall its batteries the year it went on sale, and another fire broke out six months after it claimed to have resolved the problem. In addition to batteries, fisker was recalled twice in 2012 for software problems and cooling fans.

In April 2012, A123, fisker's battery supplier, filed for bankruptcy protection in Delaware bankruptcy court. Three months later, kamal also had to stop production. That year, sandy flooded 300 of the camaras in stock after they were shut down, and insurers refused to reimburse them, adding to fisker's already tight finances. From 2008 to 2012, fisker made a total loss of $1 billion and failed to seek new investments around the world. In November 2013, fisker filed for bankruptcy protection in Delaware bankruptcy court.

Fisker holds 18 authorized patents (including 3 utility patents and 15 design patents) in the United States, and 18 patents that have been applied and announced. There are 108 patents filed and announced globally, and 34 patentfamilies.

The page contains the contents of the machine translation.

Leave Message

Hottest Categories

-

Hottest Industry News

-

Latest Industry News