hideBest Lithium Battery Stocks – Battery Stock Analysis

Feb 17, 2020 Pageview:1705

What is the best lithium battery stock to buy?

It’s really difficult to find the best lithium battery stock when you see around different lithium market where lithium is traded publicly. Surprisingly, each lithium manufacturer has important and separate operations in different zones. Moreover, an exchange-traded fund (ETF) concentrates particularly on casts of lithium in a wide range of industries. Although in battery production lithium is not a big cost driver, battery producers still not ready to minimize the amount of lithium consumption because lithium is so important they are always ready to face the higher prices of Lithium. There is a wide range of companies in the market who sale lithium but from an investment perspective you see a lot of unreliability or some kind of uncertainty.

If you own a company that rely on battery technologies or particularly on lithium battery, same like Tesla, then you probably be thinking of best lithium battery stock in market to buy for your company. There is a variety of lithium stocks that ranges from small cap lithium stocks to Australian and Canadian lithium stocks. Nowadays, we see that Albemarle is one of the best lithium stocks that one can buy for their company. They produce and develop chemicals and are the biggest lithium producing company in the world. Albemarle’s headquarter is located in Charlotte, North Carolina.

Lithium is widely used in electronics such as phones to recharge battery capacities that means its use is not just limited to electric vehicles. The stock price that Albemarle offers has been on a wild ride this is why speculators say it confidently that Albemarle is one of the company that could explode higher.

Why are lithium stocks going down?

Over previous few years, lithium stocks were considered as a great investment. In order to power the lithium ion batteries, minerals were needed in excess amount. No doubt, lithium batteries are currently considered one of the best technologies in hand, but in near future we do not see lithium ion batteries on the same position as it is today because new battery advancement is going to hit the market soon. Also, there are few reasons behind why the lithium stocks are going down.

The very first reason is the battery life of lithium ion batteries. This might be happened to everyone that their smartphone’s battery goes dead while they are on a phone call or on their way to home etc. Battery timing of electronic devices or our mobile phones is undoubtedly improved in past few years but there is still a need of much better battery life because future technologies will demand higher density with longer battery life. Breakthroughs like you can now stream videos online anywhere takes a huge amount of battery and lithium ion batteries will no longer be sufficient.

Another reason is cobalt. During the production of lithium batteries large amount of cobalt is required. DRC (Democratic Republic of Congo) is the place where about 2/3rd of Cobalt is present. DRC is considered the most unstable country in the world, this makes the import of highly sought after minerals a big problem. Moreover, Cobalt is considered as the “blood diamond” of the industries of batteries. The labor cost of cobalt extraction is enormous. Mining conditions are unacceptable and child labor is unstable. Thus, as a result we will see that there will not be sufficient amount of cobalt to balance the needs of lithium ion batteries.

The final reason is something we have already discussed above and that is the advancement in technology. People are focusing on building more powerful technologies that will meet the needs of future technologies. For example innovation of an iPhone that requires charging once in a month, innovation of cars with massive ranges and innovation of aero planes that uses battery power to run etc.

What company produces the most lithium battery?

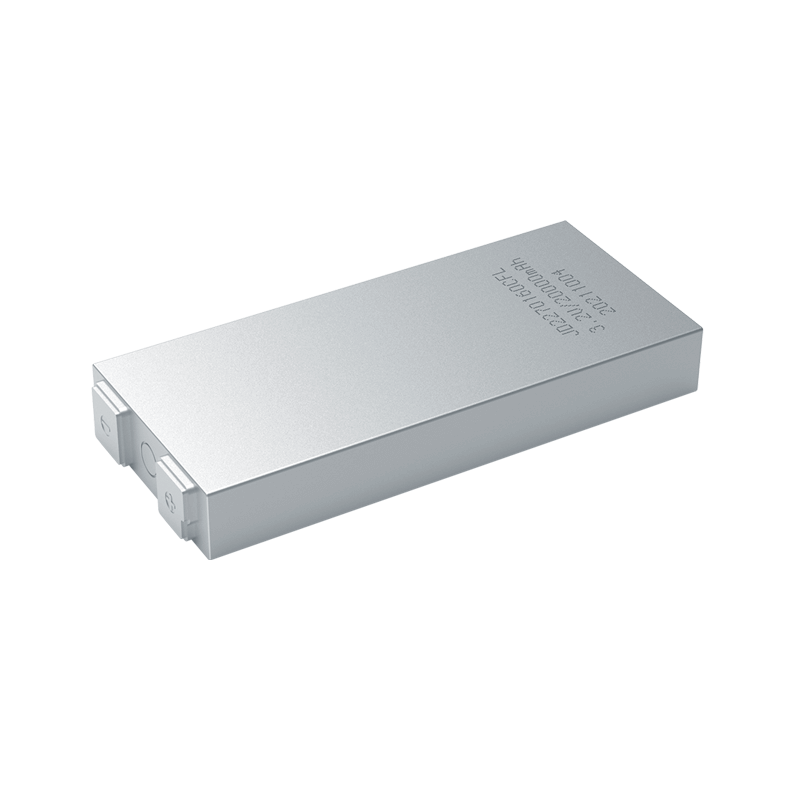

Lithium batteries use interjected lithium compounds as electrodes and require very less maintenance. These batteries are used in wide range of technologies such as personal computers, smartphones and vehicles etc. With the increasing consumer income levels and growing penetration in internet connectivity, the amount of sales of portable electronic devices such as laptops and smartphones is consistently increasing and as a result the production of lithium ion batteries in the market is increased worldwide. Even consumers these days are moving to electric vehicles from regular automobiles and these electric vehicles use lithium ion batteries to run. Moving our focus towards the producers of lithium batteries, we discuss some famous lithium ion battery producing companies:

LG Chem

LG Chem is leading lithium battery producing company in the world and is located in Korea. By the end of 2020, it has decided to triple the capacity of producing EV battery. The company is required to expand their growth rate to about 170GWh in 2024 so that it meets the target. Having new plants under development in Poland and China, it is further focusing on building a second factory in US.

Panasonic

The Japan Company using the brand name of Panasonic produces, sells, and serves electronic products worldwide. The company was founded at Kadoma, Japan, in 1918. Panasonic is the leading producer of automotive lithium batteries. It has decided to boost up its capacity of producing automotive batteries and building new branches in Chine, US and Japan. It has decided to further increase the production capacity and started producing prismatic automotive lithium batteries at Himeji factory located in Japan. Himeji factory manufactures LCD panels currently.

Toshiba

Toshiba Company was created at Tokyo, Japan, in 1875. It not only produces subsidiaries but also produces and sales electrical and electronic products worldwide which include lithium ion batteries. There are six segments through which it operates and these include industrial ICT solutions, retail and printing solutions, energy systems and solutions, storage and electronic devices solutions, infrastructure systems and solutions, and others. Furthermore, it also offers other infrastructure systems like POS systems, broadcasting and network, power, transmission and distribution, photovoltaic, railway transportation etc.

- Prev Article: High Temperature Lithium Battery-Effect and Protection

- Next Article: Puncturing a Lithium ion Battery Effect, Action and Storage

Leave Message

Hottest Categories

-

Hottest Industry News

-

Latest Industry News