Lithium Battery Stock Symbol-Stock Trade Analysis

Feb 19, 2020 Pageview:966

One of the most prominent metals you will find is lithium, which is also known as "white petroleum". Although it is usually white or grey, it turns bright red when thrown into the fire. Lithium ore was documented as a mineral in the 1790s, however, it was not until 1855 it was separated and identified as an element.

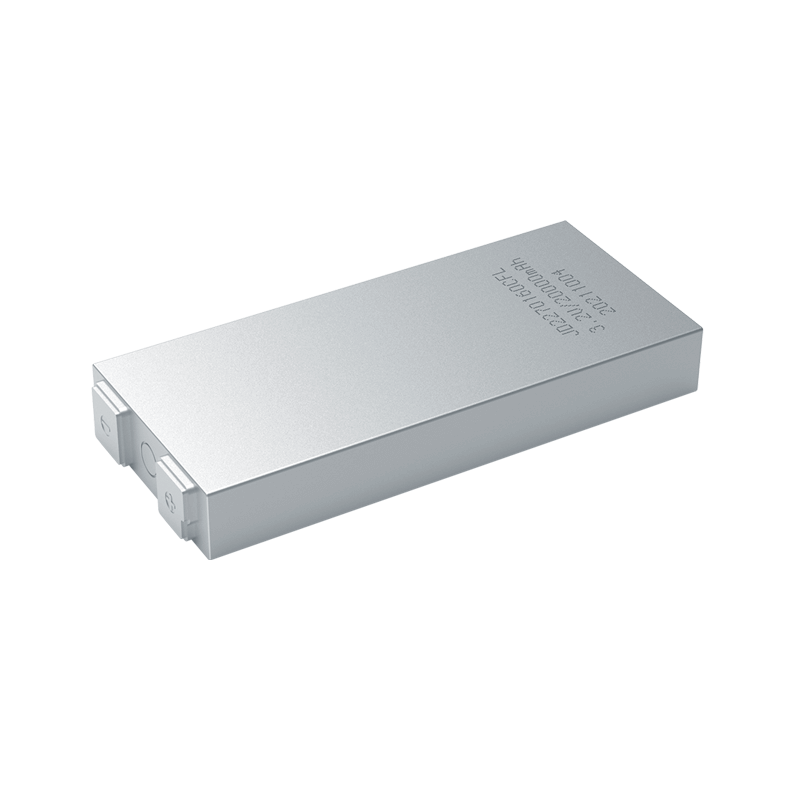

We’re talking of the silvery-grey metal from which batteries for electric cars, mobile devices and laptops are made. Yes, there is an increase in the use of lithium in the world and this is causing the demand for the materials to be on an all-time high.

And like you know, as with any coveted product, companies are trying to meet the demand of the product, and that is exactly what has happened to lithium too. After the rapid expansion of Australian mines, there has been an avalanche of new lithium inventories that have entered the market.

Is lithium traded on the stock market?

For potential investors, they want to know if lithium is traded on the stock market, so they can invest in the industry.

There is an increase in the use of lithium because more and more manufacturers now use the metal of batteries for smartphones, mobile devices, and even electric cars in other to use the device for longer and of course, lithium batteries keep and maintain charges for a longer period too, which increases the interest of investors.

The demand for lithium has caught the eye of investors and many people now want to invest in the lithium industry. Investing in lithium is one sure way to diversifying one's portfolio. However, it is important to know that the metal is highly subject to supply volatility and there may be quite a narrow or small range of investment options.

So, it seems clear enough, lithium can be traded on the stock market. But not directly as lithium, instead, you can invest in the companies that deal or are involved in lithium mining or battery production.

No matter how you see it, the demand for lithium-ion (‘Li-ion’) batteries has been predicted to increase more than tenfold between 2018 and 2030 according to a BNEF study -so this may be a lucrative investment to consider.

There is an expected increase in the demand for the material because more batteries will be made. This is mainly due to the demand surge in electric vehicles, as experts are now seeing electric cars go from about ~ 2.0% market share in 2018 to about ~ 35% by 2030.

Which company manufactures lithium batteries?

1)LG Chem

The LG Chem (a brand of Korea) is the world's leading manufacturer of lithium-ion batteries in terms of capacity.

LG Chem has got an agreement to supply the following companies: Volkswagen, General Motors (GM) Ford, Geely, Volvo, Renault, Nissan, Hyundai, Kia, and others.

And the company isn’t planning to stop there. LG Chem is currently planning to triple its battery production capacity for electric vehicles by as much as 110 GWh before 2020 runs out. The company has also set a target for itself to at least reach 170 GWh by 2024, this has to be done to reach its growth target. New factories are being developed in China and Poland, and LG Chem is also planning to build a second factory in the United States.

LG Chem's financial report reveals that there were good growth and profit in 2019 and shows promise that sales, margins and also profits are expected to improve in the year 2020 and 2021.

2)Contemporary Amperex Technology Co. Ltd.

CATL of China is the second-largest battery manufacturer in the world and the biggest Chinese battery manufacturer and has huge expansion plans.

CATL has got agreements to supply Geely/Volvo, BMW, Daimler, Volkswagen, Toyota, Honda, Nissan, and many other Chinese car manufacturers. CATL of China also recently announced its plans to build another mega-factory, which is a $2 billion German battery factory.

CATL's financial report has shown strong growth in sales, but while margins have been forecasted to decline, (although still to remain at a good level compared to other companies), profits are expected to increase.

3)Tesla

Tesla is a famous electric car maker from the United States.

It is the fifth-largest battery manufacturer in the world and the largest American manufacturer of batteries. The company has a JV with Panasonic in the Gigafactory 1 in the United States. Gigafactory in America is the largest lithium-ion production plant in the world.

Tesla focuses primarily on supplying its vehicles with battery and energy storage products and is currently the world's largest supplier of electric cars. The company is building its gigafactory in Shanghai, China, and plans a mega-factory in Europe after completion of the Chinese Gigafactory. Concerning the new Shanghai plant and the Chinese production of cars and electric batteries, it is believed that in the next three years, Tesla will depend on Chinese manufacturers of lithium-ion batteries or at the very least, on the production of Chinese cells for Tesla model 3 as well as the proposed model Y. According to Tesla, the plan for the Gigafactory 3 is to meet the production target of not less than 250,000 electric cars yearly.

Others include;

4)BYD Co.

5)Panasonic

Can you invest in lithium?

There have been lots of questions as to if one can invest in lithium. There are currently many options on the market for investing in the metal. While it may almost be impossible to buy physical lithium shares, potential investors may still buy shares from companies involved in the mining and production of lithium. Investors can also buy a special lithium ETF that provides exposure to a group or set of commodity producers.

However, potential investors need to note the following before engaging in lithium stocks. Due to the abundance of the metal as compared to precious stones like gold or platinum, it is much cheaper to get lithium than these other expensive metals. What this means is that many companies who claim to be involved with “lithium stocks” may also likely be involved in the mining and production of some other metals or chemicals.

This means that for any company that also engages in mining other products, they cannot be completely or accurately described as “pure” lithium companies.

Leave Message

Hottest Categories

-

Hottest Industry News

-

Latest Industry News